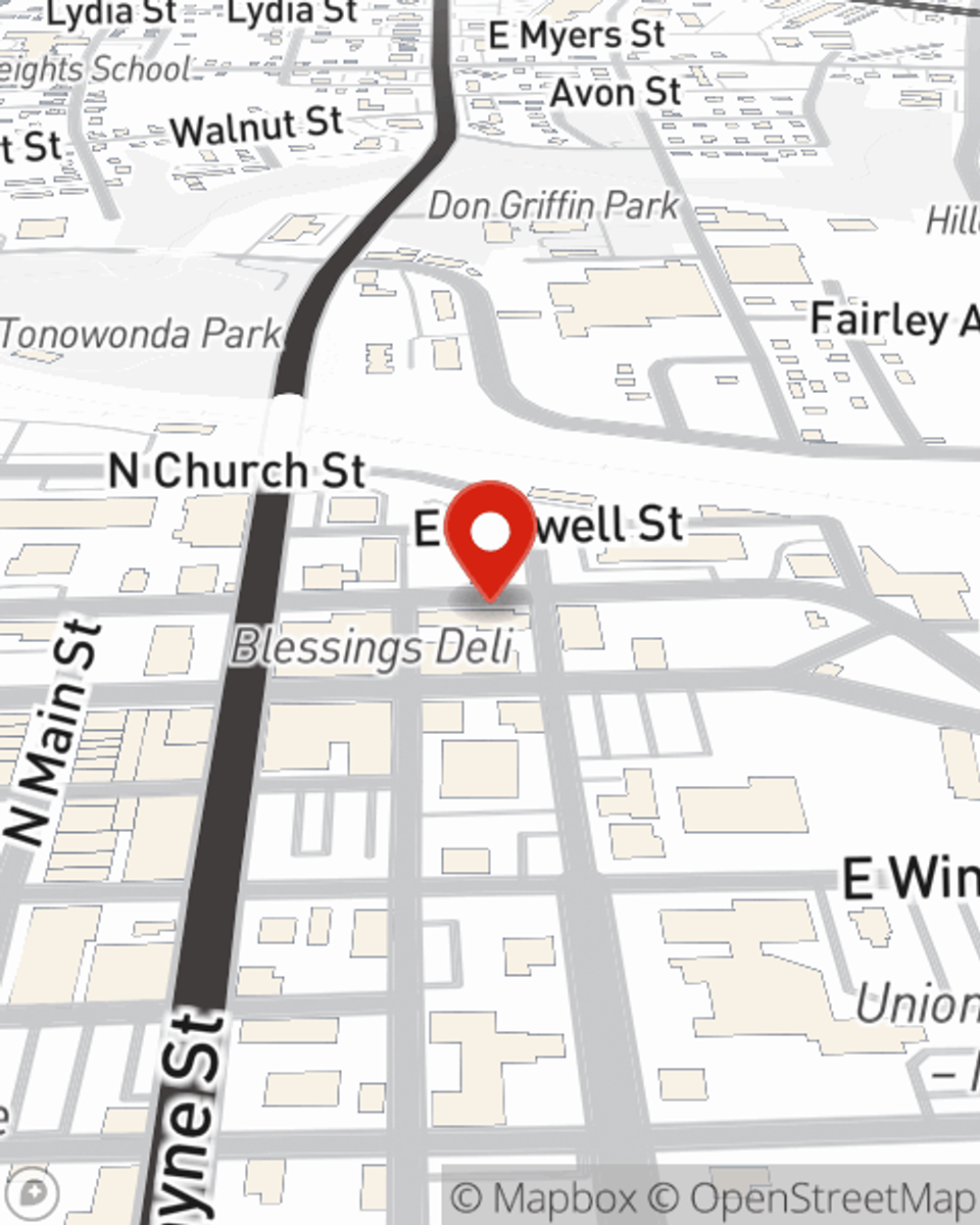

Business Insurance in and around Monroe

Looking for small business insurance coverage?

Cover all the bases for your small business

Insure The Business You've Built.

Whether you own a an antique store, a fabric store, or a pet groomer, State Farm has small business insurance that can help. That way, amid all the different options and moving pieces, you can focus on navigating the ups and downs of being a business owner.

Looking for small business insurance coverage?

Cover all the bases for your small business

Surprisingly Great Insurance

Your business thrives off your determination commitment, and having great coverage with State Farm. While you put in the work and do what you love, let State Farm do their part in supporting you with commercial liability umbrella policies, business owners policies and artisan and service contractors policies.

Let's talk business! Call Adriana Cabrera today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Adriana Cabrera

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.