Homeowners Insurance in and around Monroe

Looking for homeowners insurance in Monroe?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Home is where laughter never ends laundry is continuous, and you're insured by State Farm. It just makes sense.

Looking for homeowners insurance in Monroe?

Apply for homeowners insurance with State Farm

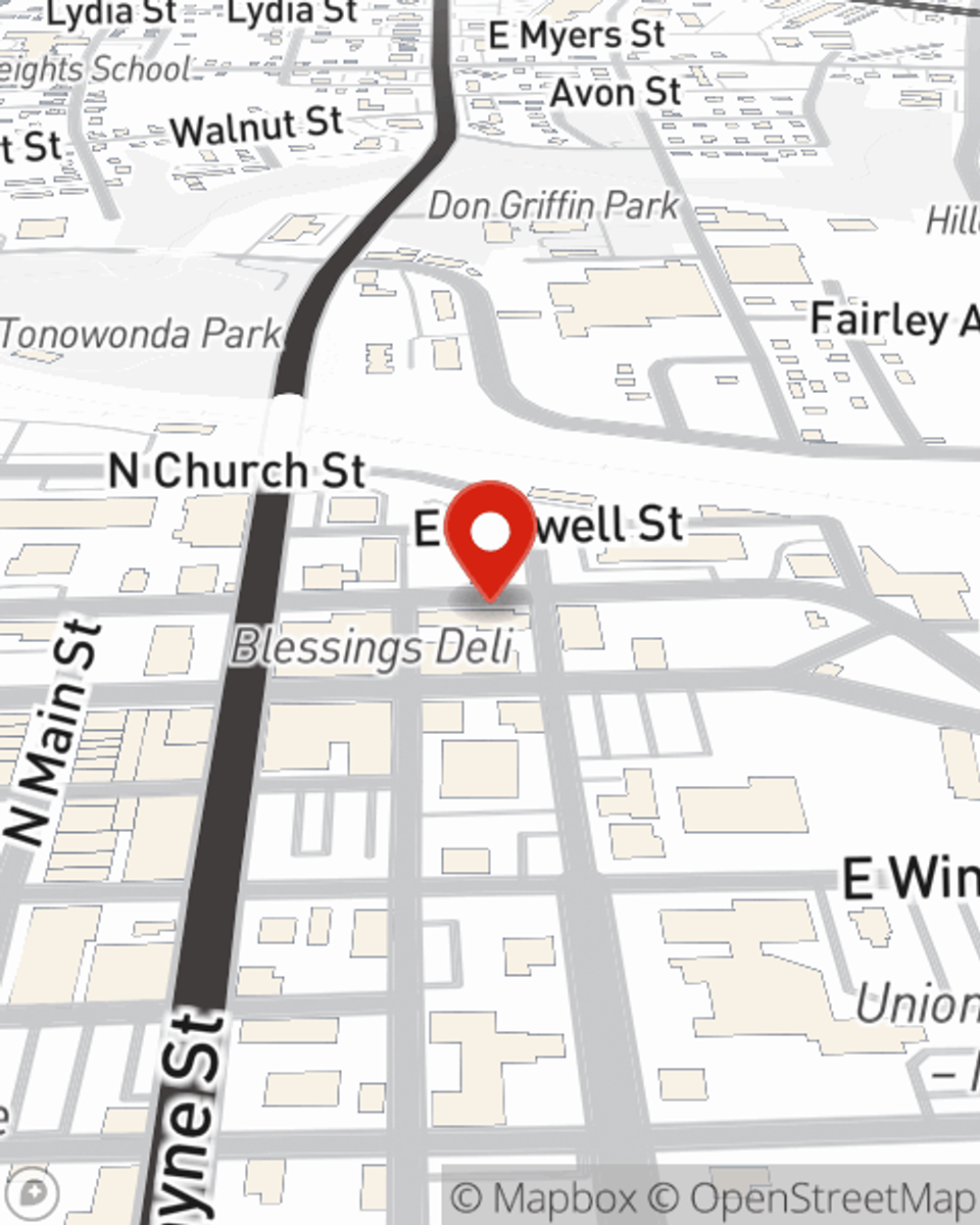

Agent Adriana Cabrera, At Your Service

Agent Adriana Cabrera has got you, your home, and your valuables shielded with State Farm's homeowners insurance. You can call or go online today to get a move on creating a policy that fits your needs.

Your home is the place where your loved ones gather, but unfortunately, the unanticipated circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Adriana Cabrera can help you put together the right home policy!

Have More Questions About Homeowners Insurance?

Call Adriana at (980) 313-8458 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to select the right safe for you

How to select the right safe for you

Home safes are available in a variety of types and have ratings to indicate how secure they are. Read on to select the best type for your needs.

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.

Adriana Cabrera

State Farm® Insurance AgentSimple Insights®

How to select the right safe for you

How to select the right safe for you

Home safes are available in a variety of types and have ratings to indicate how secure they are. Read on to select the best type for your needs.

The free Ting offer continues to help keep policyholders safe

The free Ting offer continues to help keep policyholders safe

State Farm is offering free Ting Sensor devices to qualified policyholders in participating states.