Condo Insurance in and around Monroe

Townhome owners of Monroe, State Farm has you covered.

Quality coverage for your condo and belongings inside

There’s No Place Like Home

Stuff happens.. Whether damage from weight of sleet, theft, or other causes, State Farm has fantastic options to help you protect your condominium and personal property inside against unexpected circumstances.

Townhome owners of Monroe, State Farm has you covered.

Quality coverage for your condo and belongings inside

Condo Coverage Options To Fit Your Needs

You can relax with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with fantastic coverage that's right for you. State Farm agent Adriana Cabrera can help you understand all the options, from replacement costs, bundling to liability.

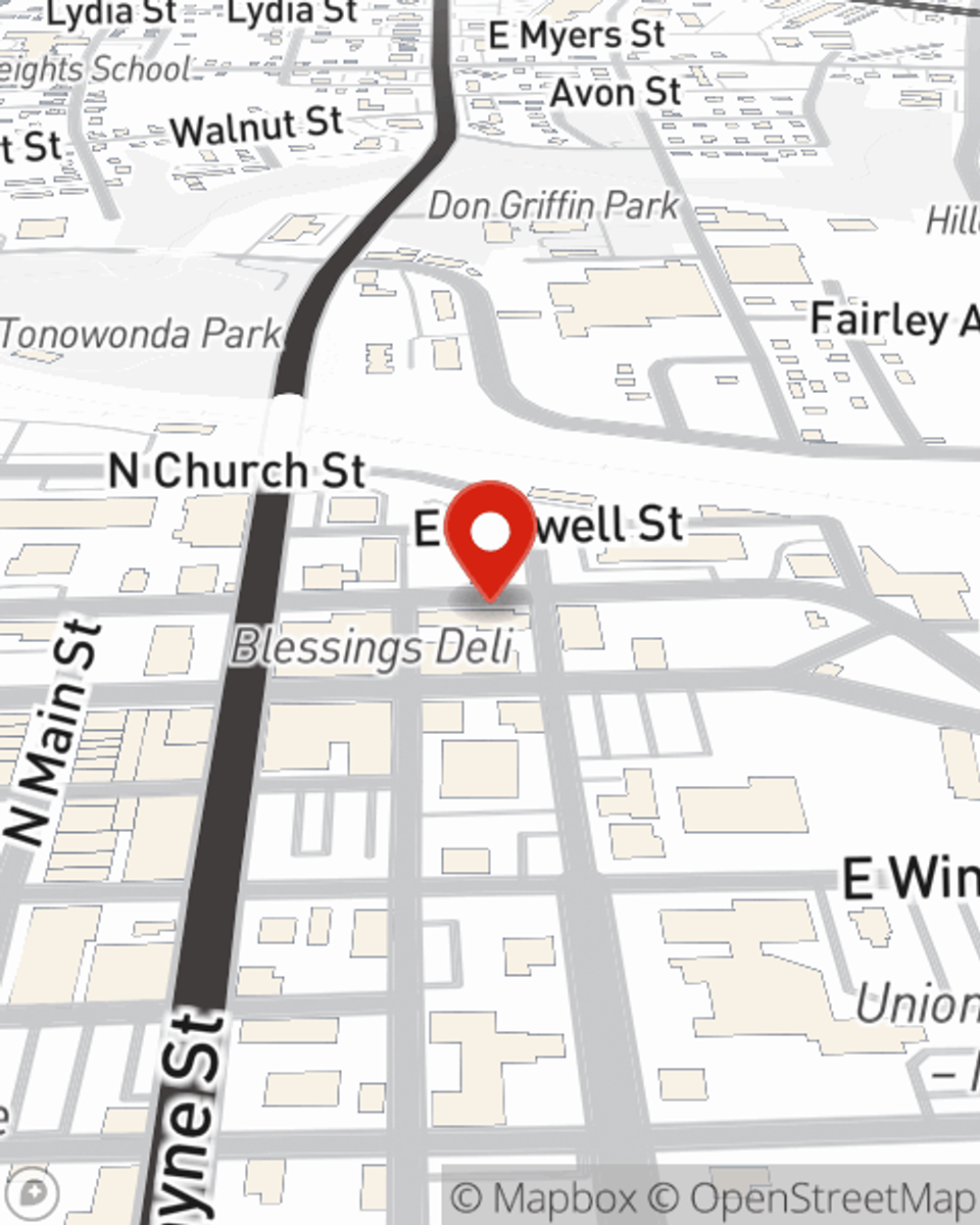

Call or email State Farm Agent Adriana Cabrera today to discover how one of the well known names for condo unitowners insurance can help protect your condominium here in Monroe, NC.

Have More Questions About Condo Unitowners Insurance?

Call Adriana at (980) 313-8458 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Adriana Cabrera

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.